Banks have money to lend and are always on the lookout for new customers. Smallholder farmers need financing to improve their yields and incomes. A perfect match? Unfortunately, no. Even as many financial institutions seek socially responsible lending opportunities, they generally overlook smallholder farmers as too risky—banks can’t gauge the farmers’ creditworthiness, or their ability to pay back loans even at low interest rates.

Technology might provide a way around this conundrum. One company is proposing a possible solution: using geographic information systems (GIS), or geomapping as some refer to it, to deliver intelligence to banks so they may better assess the risks of lending to smallholder farmers. This exemplifies a more general point relevant to our strategy at Grow Further–while farmer adoption of new technologies can be slow for a variety of reasons, agricultural technology relevant to smallholder farmers needn’t necessarily be adopted by farmers themselves in order for them to see benefits.

Exploring the potential

Last year, the Irish nonprofit Small Foundation commissioned Palladium Group, a specialized research and consulting firm, to study the potential for using GIS-gathered data to convince lenders to do business with smallholder farmers in developing countries. The United States Development Finance Corporation (DFC) also expressed interest in the concept. The results of that research came out in a report made public last January, titled “A Paradigm Shift in Lending to Smallholder Farmers: The Potential of Geomapping Technology.” In it, Palladium says the concept is very feasible but would probably require a major top-down solution to see it become reality. They propose establishing a special facility to create a new smallholder lending business model based on GIS surveys and data gathering (https://smallfoundation.ie/geomapping-technology-unlocking-transformational-potential/).

Palladium senior associates Olivia Morgan and Erin Leyson drafted the study. In an interview, co-author Morgan told Grow Further that Small Foundation and DFC are aware GIS technology is being used by some entrepreneurs and development agencies to give advice directly to smallholders, but they wanted to discover whether or not this same technology suite could be used to convince banks that smallholders are a good investment. “They were interested in the benefits of GIS,” she explained. “They wanted to figure out if there are other use cases, and if so, what are they.”

The power of GIS

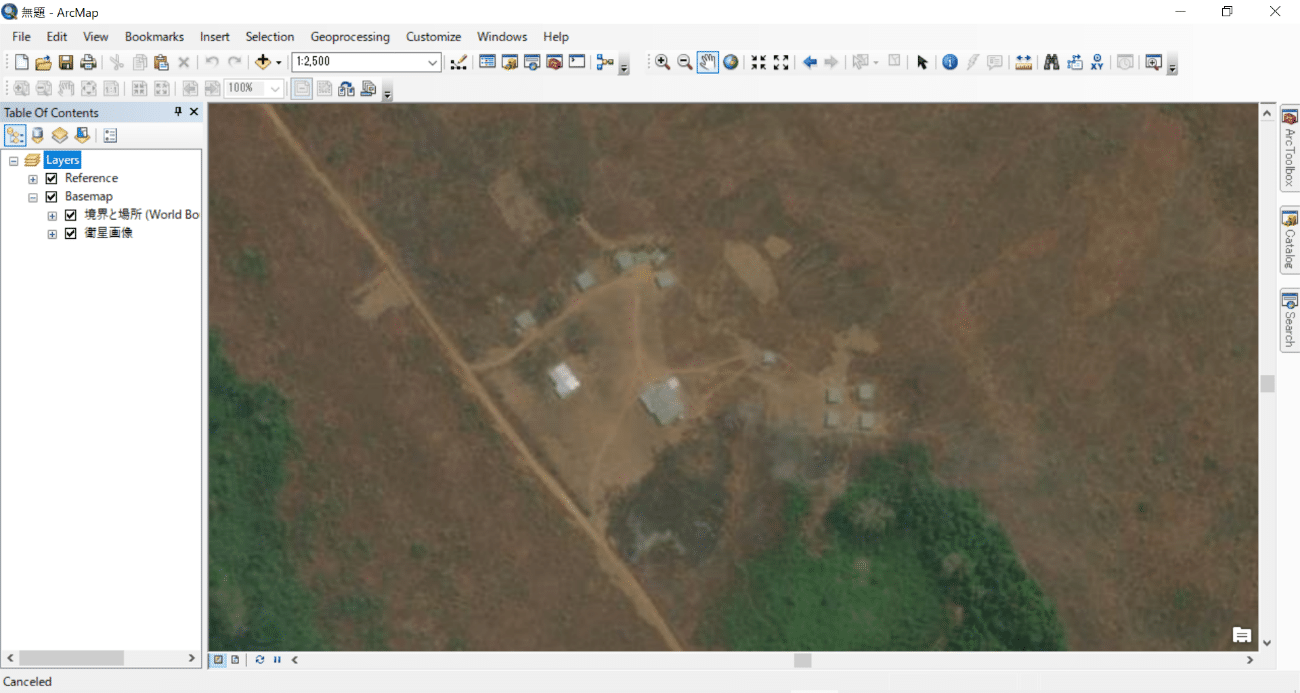

For unfamiliar readers, GIS is a type of mapping software that allows users to organize data by associating it with representations of real physical aspects of Earth’s surface. Specific locations, paths, and areas are depicted as points, lines, and polygons, respectively. This vector data is generally overlaid onto raster data, or two-dimensional maps or photographs serving as the foundation for most GIS projects. In using geomapping for smallholder financing purposes, Palladium and Small Foundation are proposing lenders make digital models of smallholder farmers’ plots via points or polygons and track how these lands are associated with real or projected changes to regional weather, climate, or market forces.

For example, a bank could use GIS to give itself a kind of bird’s-eye survey of where precisely a farmer is growing crops, and then marry this information with other GIS data showing how the climate in that area has changed or is projected to change over time, or even how regional market conditions have been shifting. Many companies are already collecting this type of micro and macro data anyway, as Morgan pointed out. The missing piece is delivering this same type of data in a form that banks can use to make lending decisions.

Convincing banks

Geomapping for smallholder financing is tantalizingly close. Many lending institutions already have relationships with companies that incorporate GIS or geomapping into their activities—Morgan offered as one example Nairobi-based Apollo Agriculture. However, banks themselves have yet to take up the technology. “We found that what’s most common is the financial institutions are using contractors, so they’re using the technology providers,” she explained. “They’re not doing it sort of in-house if you will.”

Given that banks are reluctant to lend to smallholders because they don’t know a lot about them, the next step is to convince these same lenders to develop their own in-house capabilities to utilize geomapping regularly to assess the risk profiles of thousands of smallholders looking to borrow modest sums ideally at low-interest rates. “That’s definitely an idea worth exploring,” Morgan added.

Palladium proposes that interested parties, perhaps nonprofits or development banks, set up a special financing facility to encourage broader uptake of GIS mapping and data collection of smallholder farms. The thinking is this might help to better mainstream and standardize the practice, eventually convincing banks to adopt it themselves as a vehicle for expanding lending opportunities to smallholder farmers with less risk. In other words, “to essentially show proof-of-concept to these financial institutions so that they would be more willing to adopt it on a long-term basis,” Morgan said.

Grow Further could be one of these parties directly supporting this work. We’re also looking at a variety of other geomapping projects and have received volunteer interest from several GIS scientists.

— Grow Further

Photo credit: A satellite photo of a smallholder farming community in Gabon depicted in ArcGIS.